UWDataHubTM

Underwriting Workbench

Insure Smarter, Underwrite Faster

Transform your underwriting process with cutting-edge automation and real-time insights.

Solving Underwriting Challenges

Challenges

High Quote Volume

Administrative burdens

Diverse Risk Assessment

Understaffed with Limited Underwriters

Limited visibility on small group health insurance options.

.

Data Silos and Fragmented Systems

Hurdles in Technological Integration

Complex Renewals and Claims Experience

Inefficient Workflow and Process Management

Speed and Personalization

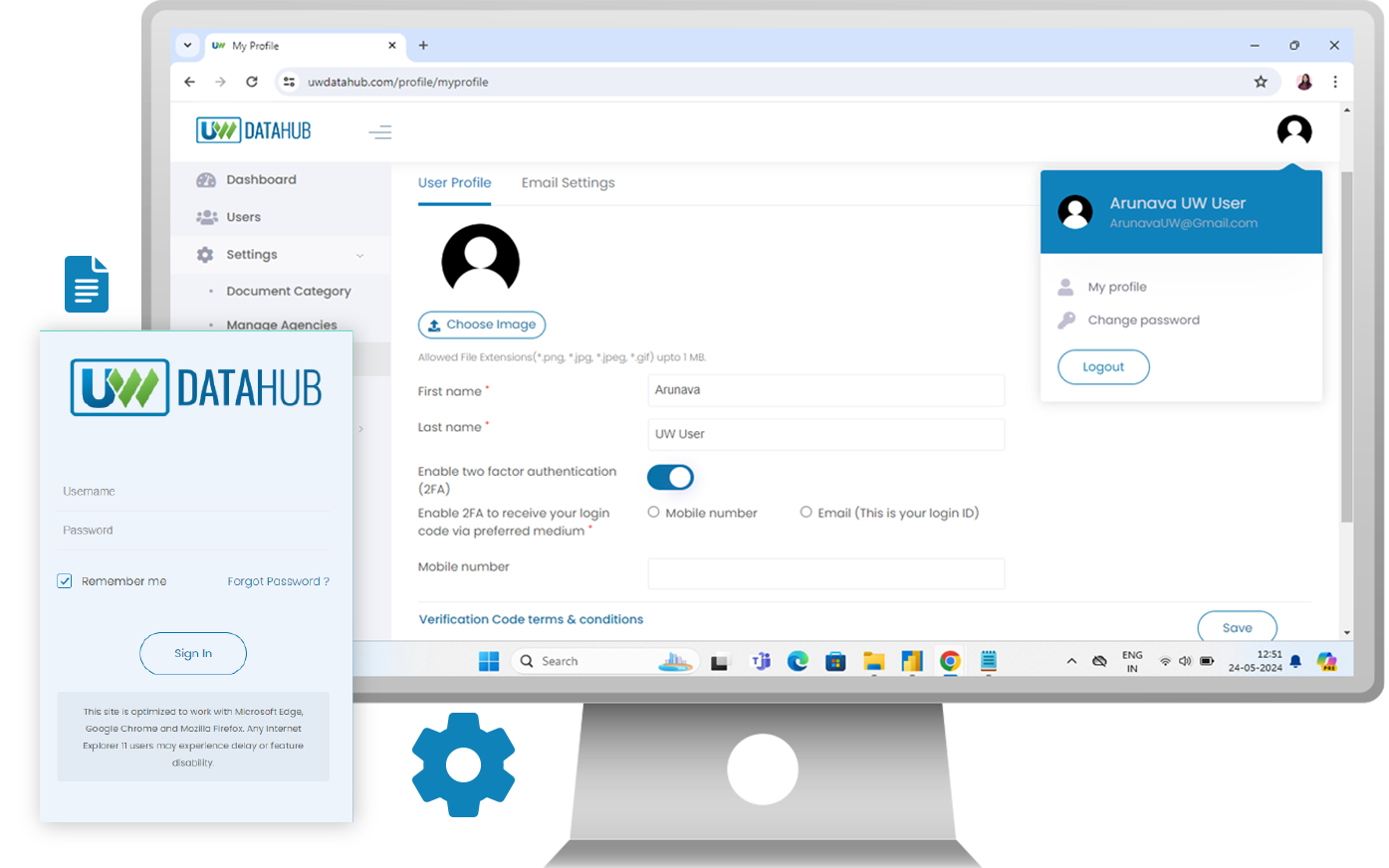

UWDataHub Underwriting Workbench

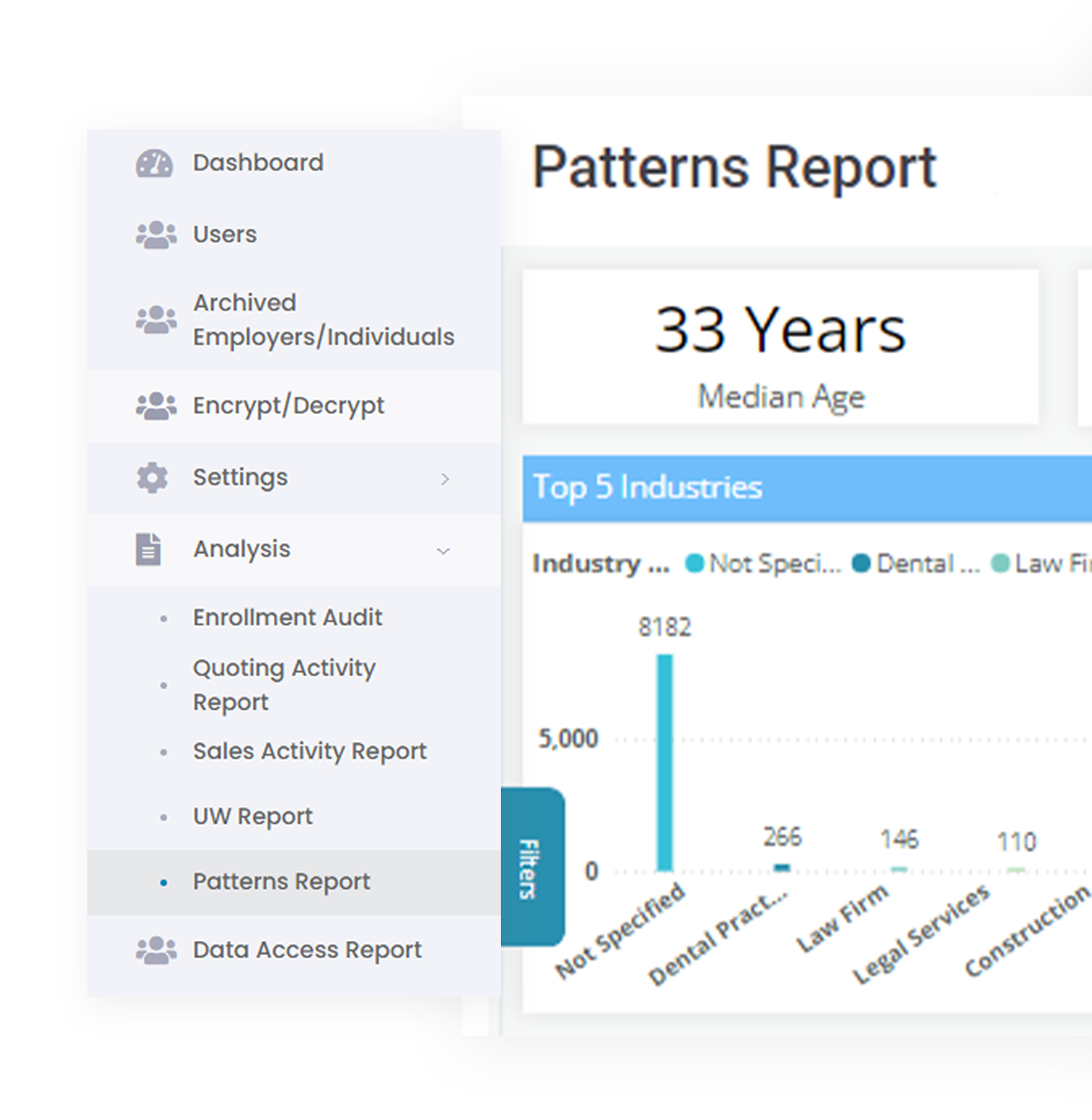

UWDataHub Underwriting Workbench is a cutting-edge solution tailored for Group Health Insurance Carriers, MGUs, MEWAs, Pooled Risk, Captives, and Self Insured Groups. It revolutionizes underwriting processes by seamlessly automating data input, risk assessment, and decision-making.

With its centralized dashboard, it offers

Real-time insights

Reducing manual efforts

Optimizing workflow efficiency for unparalleled productivity.

Key Features

AI-Powered SmartExtractorTM

Efficiently captures and structures data, reducing manual errors.

Enhanced Workflow Reporting Tools

Detailed insights for better risk management.

Predictive Rate Calculation

Accurate, competitive pricing with actuarial algorithms.

Document Management

Securely handle, store, and retrieve documents.

SmartMatchTM Plan compare

Customized Plan Recommendations tailored solutions to meet customer needs.

SmartRulesTM Engine

Consistent and streamlined decision-making processes.

Flexible Underwriting Methodologies

Support for IHQ, Census-only, or Illustrative rates.

Manual Adjudication and Automated Processing

Flexibility in handling risk scores.

Real-Time Collaboration Tools

Enhance teamwork and communication.

Knowledge Management

Capture Underwriting knowledge with the inbuilt rule book.

Benefits for Your Team

Executives

ROI and Increased Efficiency: Lower costs, higher productivity.

Faster Product Launches: Speed up time-to-market.

Competitive Advantage: Improved accuracy and reliability.

Managers

Workflow Efficiency: Streamline operations.

Improved Data Quality: Accurate and reliable data.

Better Collaboration: Enhanced teamwork.

Underwriters

Reduced Manual Effort: Focus on strategic tasks.

Enhanced Decision-Making: Real-time insights.

Improved Job Satisfaction: Higher morale and job satisfaction.

Brokers

Streamlined Data Collection: Easy data submission.

Improved Quoting Process: Accurate quotes, faster.

Enhanced Client Management: Better organization and tracking.

Why Work With Empowered Margins?

Rapid Deployment

Discovery to production in less than 16 weeks.

Smooth Integration

Existing systems and broker aggregators.

Ongoing Support

Continuous support and customization.

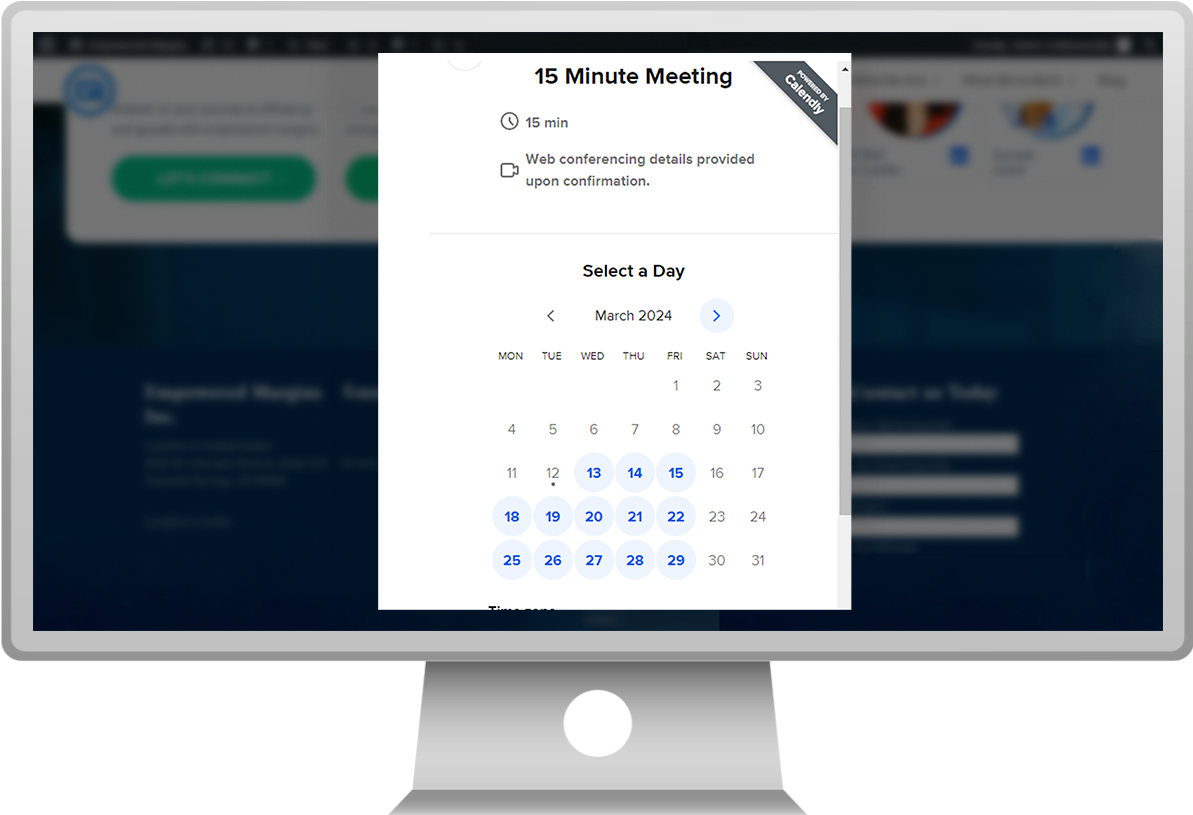

Engage with Us

Experience UWDataHub Underwriting Workbench Firsthand

Discover how UWDataHub Underwriting Workbench can transform your underwriting process. Sign up for a free demo to see the benefits for yourself.

FAQs

What is UWDataHub Underwriting Workbench?

UWDataHub Underwriting Workbench is an advanced underwriting workbench designed specifically for Group Health Insurance Carriers, MGUs, MEWAs, Pooled risk, captives and Self Insured groups. It integrates automation, AI-driven insights, and real-time data to streamline underwriting processes, enhance accuracy, and boost productivity.

What industry problems is UWDataHub Underwriting Workbench addressing?

UWDataHub Underwriting Workbench addresses key challenges in the insurance industry, including inefficient data collection, slow decision-making processes, fragmented systems, and high operational costs. By automating workflows and providing real-time insights, UWDataHub Underwriting Workbench enhances efficiency, accuracy, and profitability.

How is UWDataHub Underwriting Workbench different from other quoting tools?

Unlike traditional quoting tools, UWDataHub Underwriting Workbench offers a comprehensive underwriting workbench that integrates advanced automation, insights, and seamless system integration. This allows insurers to streamline their processes, improve risk assessment, and make informed decisions faster.

What aspects of Underwriting does UWDataHub Underwriting Workbench automate?

UWDataHub Underwriting Workbench automates several aspects of the underwriting process, including data input, risk assessment, decision-making, and workflow management. It also offers features like SmartExtractor ™, SmartRules ™, SmartMatch ™, to enhance efficiency and accuracy.

How quickly can UWDataHub Underwriting Workbench be implemented?

UWDataHub Underwriting Workbench can be deployed from discovery to production within 16 weeks, ensuring rapid integration and quick return on investment.

How does UWDataHub Underwriting Workbench improve underwriting efficiency?

UWDataHub Underwriting Workbench automates data input, risk assessment, and decision-making processes. It provides real-time data and insights through a centralized dashboard, significantly reducing manual efforts and enhancing workflow efficiency.

Can UWDataHub Underwriting Workbench integrate with our existing systems?

Yes, UWDataHub Underwriting Workbench is designed for seamless integration with existing systems and broker aggregators, ensuring smooth data flow and reducing data silos.

How does UWDataHub Underwriting Workbench ensure compliance with regulatory requirements?

UWDataHub Underwriting Workbench includes built-in compliance management tools and activity logs to ensure adherence to regulatory requirements, reducing the risk of non-compliance.

What are the key features of UWDataHub Underwriting Workbench?

Key features include AI-Powered SmartExtractor, Centralized Dashboard, Rule Engine Automation, AI-Driven Risk Assessment, Customizable Workflows, Document Management, Comprehensive Reporting, Predictive Rate Calculation, Real-Time Collaboration Tools, and Compliance Management.

Who benefits from using UWDataHub Underwriting Workbench?

Executives, managers, underwriters, and brokers all benefit from UWDataHub Underwriting Workbench through improved efficiency, better data quality, enhanced collaboration, reduced manual efforts, and improved decision-making.

How does UWDataHub Underwriting Workbench improve team collaboration?

UWDataHub Underwriting Workbench features real-time collaboration tools and communication modules that foster better teamwork, improve coordination, and reduce data silos.

Can UWDataHub Underwriting Workbench handle complex risk assessments?

Yes, UWDataHub Underwriting Workbench uses AI-driven risk assessment and predictive rate calculation to handle complex risk profiles with high accuracy and consistency.

How does UWDataHub Underwriting Workbench enhance customer satisfaction?

By providing real-time data and insights, and offering customizable plan recommendations, UWDataHub Underwriting Workbench enables faster and more personalized service, meeting customer expectations effectively.