AI and Automation are revolutionizing the underwriting process, making it faster, more accurate, and more customer-centric. Automation plays a key role in this transformation, bringing efficiency, accuracy, and cost savings. Additionally, these technologies enable insurers to develop new products rapidly, customize offerings, and go to market faster, thus staying ahead of the competition. As the insurance industry continues to evolve, AI will be a critical driver of innovation and success.

Summary of Key Points

Part 1: What Are the Challenges in Traditional Underwriting?

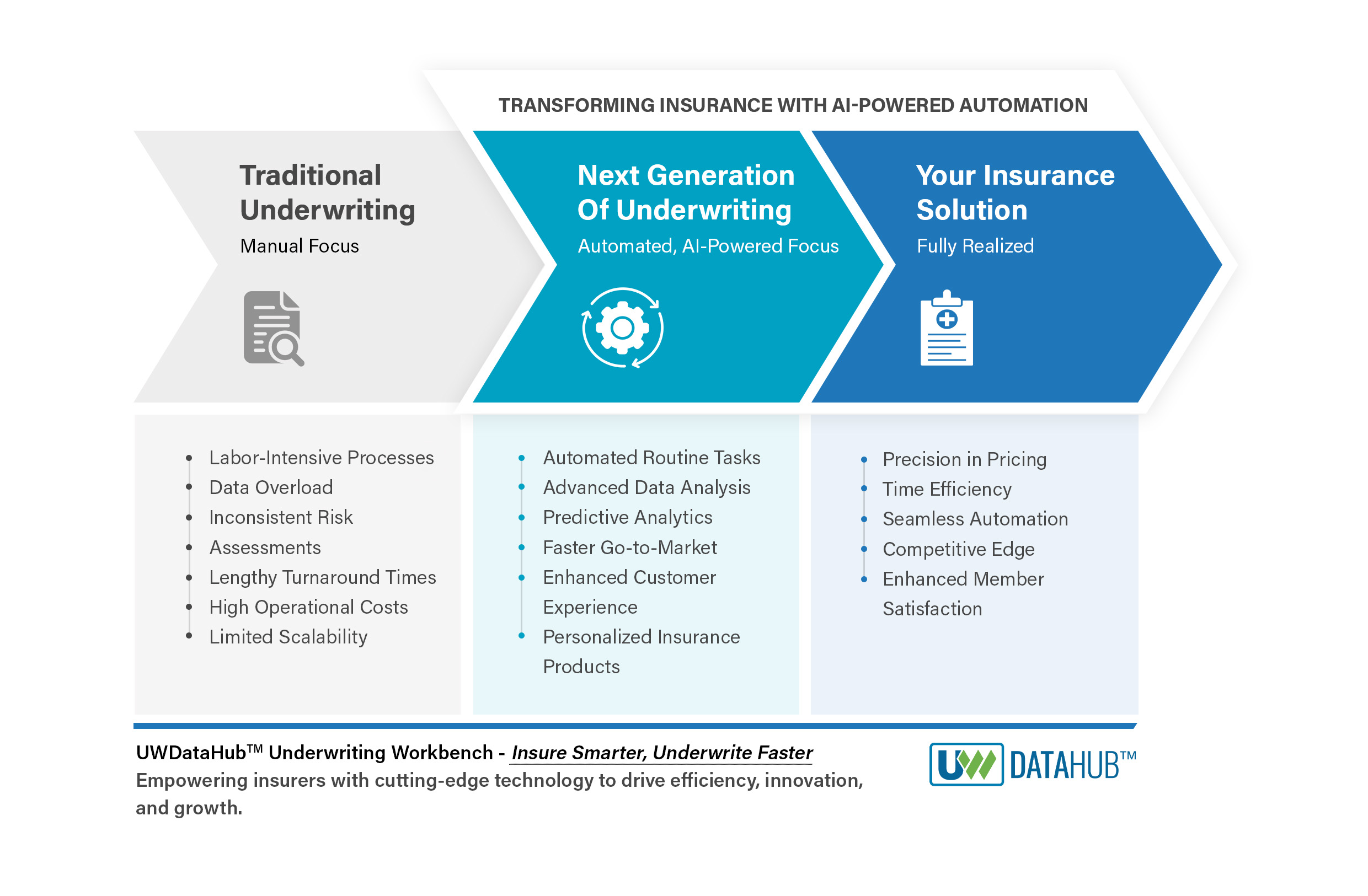

Traditional underwriting faces significant challenges such as labor-intensive processes, data overload, inconsistent risk assessments, lengthy turnaround times, limited scalability, high operational costs, and an evolving risk landscape.

Part 2: How Are AI and Automation Revolutionizing Underwriting?

AI and automation address these challenges by automating routine tasks, enhancing data analysis, providing predictive insights, and improving the customer experience.

Part 3: How Do AI and Automation Enable New Products and Faster Go-to-Market?

These technologies drive rapid product development, customization, and faster go-to-market strategies, enabling insurers to stay competitive and meet customer demands effectively.

Part 4: What Does the Future of Underwriting Look Like?

The future of underwriting will see enhanced predictive modeling, straight-through processing, personalized insurance products, improved fraud detection, seamless customer experiences, and integration with emerging technologies. Continuous learning, regulatory compliance, workforce transformation, and strategic decision-making will also play pivotal roles.

The Way Forward

By automating routine activities like data entry, document verification, and initial risk assessments, underwriters are liberated from repetitive and time-consuming duties. This shift allows them to focus on complex decision-making and strategic activities, thereby enhancing their professional satisfaction and productivity. However, it’s important to acknowledge that adapting to these technological advancements can be challenging. Change can be difficult, requiring underwriters to learn new skills and adapt to new processes. AI’s advanced data analysis capabilities provide underwriters with comprehensive insights, enabling more accurate risk assessments and better-informed decisions. Additionally, predictive analytics offers a forward-looking perspective on potential risks, further refining the underwriting process. Despite the initial hurdles, these technological advancements ultimately create a more dynamic and fulfilling work environment, where underwriters can leverage their expertise more effectively and contribute to innovative solutions. Ultimately, AI and automation transform underwriting into a more efficient, precise, and rewarding field, benefiting both the professionals involved and the broader insurance industry.

For insurers, the time to act is now. Embrace AI, invest in data and talent, and foster a culture of innovation to unlock the full potential of AI in underwriting. The future of insurance is here, and it is powered by AI and automation.

DataHub.Insure Is At The Forefront Of This Revolution

offering cutting-edge AI-driven solutions for the insurance industry. Discover how our innovative underwriting workbench can transform your underwriting process and drive profitability in the new era of insurance.