Revolutionize Your insurance Quoting

Process with UWDataHub Portal

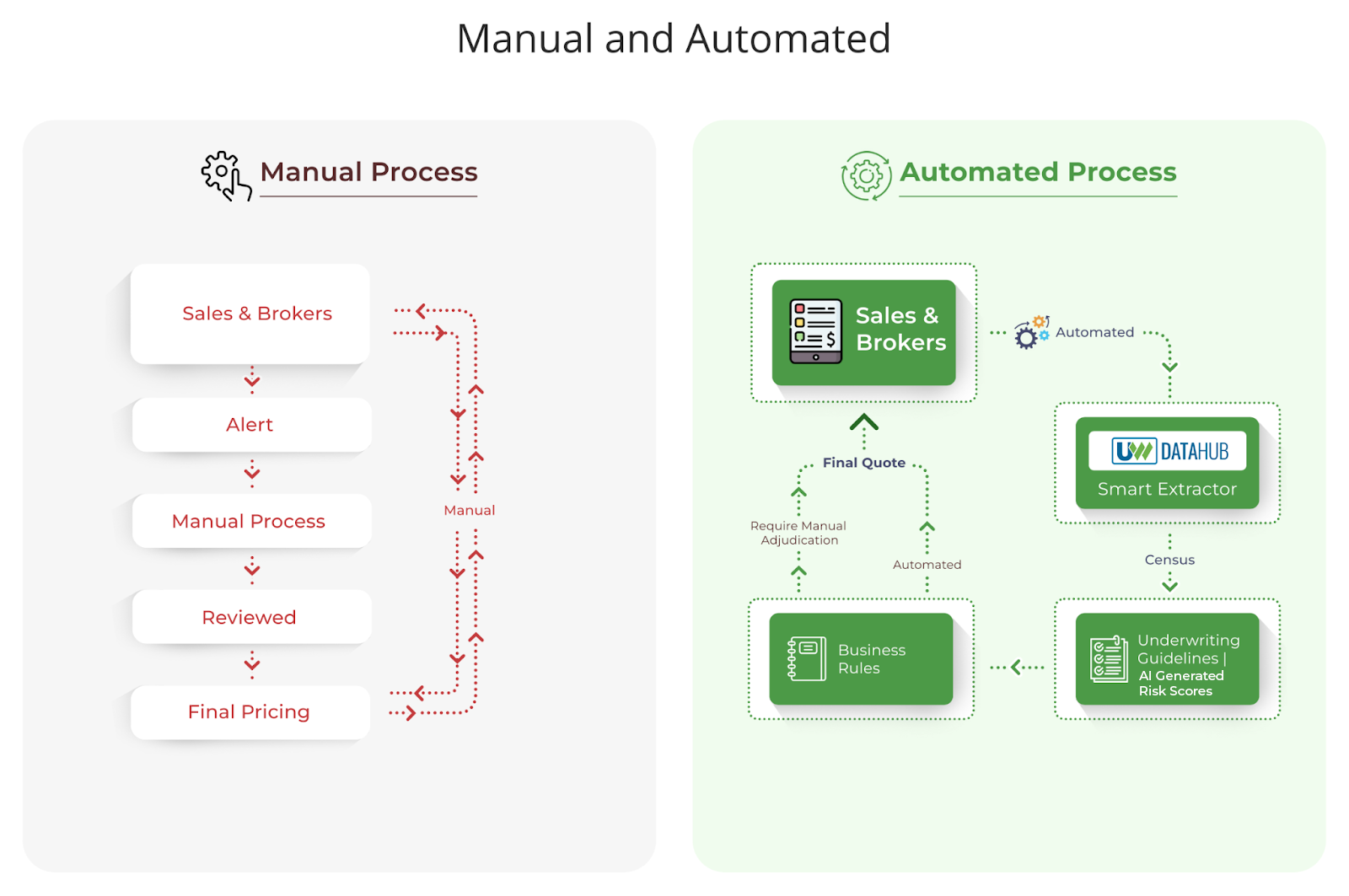

To streamline and scale Census to Quote Workflow

UWDataHub streamlines the entire underwriting process, from initial data collection and illustrative quoting to full underwriting and plan selection to Enrollment Auditing. Our platform efficiently guides you to the best plan proposals and culminates in final proposal generation, complemented by insightful reporting analytics.

Automation | Visibility | Simplify

Question? Contact our team

It is difficult to Build High Quality and

Secure Custom Data Solutions For Underwriting Teams

Don’t be left behind from the changes in the industry & the future of Underwriting

Save your Team Time and

Increase Revenue

What sets UWDataHub apart is its integration with advanced underwriting models and rating factors, along with a customizable business rules engine. So – whether you’re handling an association book of business or a level-funded plan, UWDataHub’s rules engine will adapt to your specific requirements with ease.

This software comes in SaaS or Custom versions and has been successfully implemented with many Payers, MGUs, MEWAs and even PEOs.

Question? Contact our team

Leverage Experience

Our team has over ten years of experience developing underwriting focused software solutions

Design Workflow Automation

Maximize Efficiency in your Underwriting process with UWDataHub

Increase Influence

Innovative web solution to increase revenue and scalability. Increase synergy between Sales and Underwriting

Underwriting has seasonal peaks which can be overwhelming, allow our UWDataHub to provide streamlined visibility to all stakeholders for census to sale.

In today’s rapidly evolving underwriting landscape, we understand that your team is navigating a complex web of challenges.

- Rising Quote Volumes and Competitive Pressures: The surge in quote volumes, coupled with the need for competitive pricing, has heightened the demand for not only accurately capturing risk but also ensuring swift turnaround times and transparent communication about risks. We recognize the balancing act this requires and the strain it can place on your team.

- The Accuracy Paradox: Achieving both speed and accuracy in quote generation is indeed a double-edged sword. This delicate equilibrium, striving for enhanced accuracy without sacrificing turnaround times, presents a paradoxical challenge that modern underwriting teams face daily.

- AI-Powered SmartExtractor: We appreciate the burden that varying data formats and the potential for error place on your team. Causing tax on your time as a result of disorganized data, creating mental distraction and error.

- Flexible Actuarial Valuation: With the market’s demand for innovative products, the complexity of managing diverse risk assessment methodologies can be overwhelming. The need for efficient tools to navigate this change management is more pressing than ever.

- Customized Plan Recommendations: As consumer options broaden, from ICHRAs to level-funded plans, there’s a growing expectation for transparent decision-making support. This demands a retooling of technology on your end to meet these evolving client needs.

- Beyond Risk Assessment: Underwriting teams are now integral to the full sales process, a shift that extends responsibilities beyond risk assessment to full-service proposal creation. We empathize with the tension arising from these expanding expectations.

- Technology Integration Challenges: The hidden cost of technology stacks, including the strain of managing data across multiple platforms, cannot be overstated. Your need for interoperable solutions is clear and urgent.

- Workflow Reporting Needs: Your team’s efficiency is now under the microscope, with a need for analytical tools that provide insights into workflow, close ratios, and trends in service and quoting.

Interested in seeing how SmartPlan Navigator can transform your underwriting process? Let’s arrange a brief meeting for a deeper dive.

Our insurance software company has successfully delivered dozens of InsurTech Solutions and our core focus is serving underwriting teams with our core offering of the Underwriting Data Hub

![]() Empowered Margins delivers the analysis we need in customized actuary software solutions that we wouldn’t think about otherwise. They go the extra mile by collaborating to design a solution, bring technology at a higher level and rate an easy 10 out of 10 – a tech partner, not just a tech vendor.

Empowered Margins delivers the analysis we need in customized actuary software solutions that we wouldn’t think about otherwise. They go the extra mile by collaborating to design a solution, bring technology at a higher level and rate an easy 10 out of 10 – a tech partner, not just a tech vendor.

– Ron Cornwell, Principal & Consulting Actuary![]()

Our Key Features

Manage User

UWDH allows you to Manage uw and broker users, set-up document requirements and business rules centrally

Data Collection

Enable data collection process for Census based or Health App based underwriting

Data Integration

Integrate with industry standard underwriting guidelines that can be AI or debit based

Generate Data

Generate quote requests and generate proposals automatically

Analyzation

Analyze reports of performance of underwriting KPIs, Enrollment hygiene and Patterns of health conditions

UWDataHub can be Customized to your Teams Workflows.

Our Process

Walkthrough

Walkthrough

Give us a walkthrough of your solution

Solution Outline

Solution Outline

We provide a solution outline with options and expected budget

Deliver your MVP

Deliver your MVP

Launch v1.0 to the market to start engaging your market

Transform the Hassle into Action

You can leverage EMs 10+ years of experience having built dozens of innovative InsurTech solutions for UnderWriting Teams for over 30 different companies that will allow for increased automation, scalability and allow your skilled UW’s the time to focus on tasks that best utilize their talents.